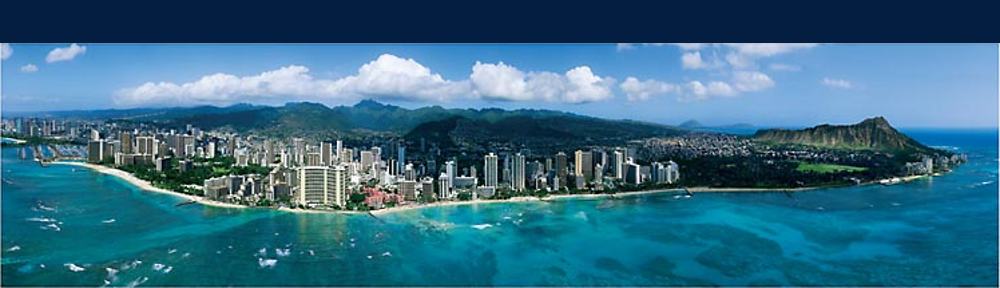

Digging further back…In December 1942, University of Hawaii Professor Carey D. Miller sent a 6-page letter to friends with a month-by-month account of what it had been like in Honolulu after the attack on Pearl Harbor and the US entry into WWII.

For example, December 1941:

“Christmas comes and goes, dinner parties are called off and many work all day long. Each night we gather in our little blackout room and listen anxiously to the war news.”

And from December 1942:

December 1942: “Haru, my 64 year old masseur, who for almost 20 years has rubbed the cricks out of my tired shoulders and soothed my headaches with her strong and supple fingers has expressed the feelings of many of us when she says, ‘I tink God verry sorry see his children fight. Erry morning I say, Aloha God, please, war pau.’ “

Read Miller’s 1942 letter here.

Miller wrote another Christmas letter to friends in December 1944. In it, she expressed thanks for a number of things, and her list tells you an awful lot about the times.

• “…a good job and sufficient health and energy to carry on.”

• “…a comfortable home of our own. The housing situation is so acute in Honolulu that we feel almost guilty to have a spare room, even though it is frequently used by newcomers and visitors.”

• “…space to raise most of our own fruits and vegetables which give us a better diet and means jut that much less food to be shipped in.”

• “…the (household) help that we have….A girl from one of the other Islands who is attending business school is with us for the second year. She prepares the evening meal and washes the dishes. Her repertoire is limited, but she really does very well.”

• “And we have a yard man!”

• “…it has not been necessary to restore the black out. We can now turn on any kind of lights anywhere, any time! (Except, of course, during an air raid alarm).”

• “…I am thankful for good musical programs whether from regular records or rebroadcasts of such programs as the N.B.C. symphony concerts.”

• “…the event which will evoke the greatest thankfulness will be the end of the war.”

And so it goes on this Christmas morning 67 years later.

shareshare